By 2013, distressed homes accounted for 14% of all sales nationally. In 2012, they were at 22%. Most people understand foreclosures come about when the owner no longer makes payments on their mortgage. At this point, the bank works to take back ownership of the property and then sells it off. Short sales are different because the owner and the bank work together to sell the property prior to the home going into foreclosure. Why is it called a short sale? Because the sale price is lower than what the owner currently owes the bank. Put another way: It is when the owner owes more than what they can currently sell the home for, and the bank holding the loan agrees to accept the loss – the bank “sells short” of the amount owed.

Short sales benefit both the bank and the homeowner. The bank loses less money in the transaction than they would with the foreclosure because they sell the house at its “current market value” and have less administrative costs than the foreclosure process. The homeowner benefits because their credit is not as adversely impacted as it might have been if the home had gone into foreclosure especially if they continue to make payments on their mortgage during the short sale process. Good news, 30% of homes in America are free & clear. 70% of homes in America have mortgages.

The Market in Miami-Dade

The lowest inventory levels over the last 10 years occurred in April 2005, at 2,778 single family home inventory and 4,983 condo inventory. Peak inventory reached 17,070 homes and 24,905 condos by July 2008. By December 2013, single family home inventory decreased 70% to 5,194 homes and condo inventory decreased by 63% to 9,338 condos. Inventory of non-distressed single family homes was at 75% and non-distressed condo inventory was at 85% by the end of 2013. There has been double-digit annual median price increases for over 24 months for both single-family homes and condos in both Miami-Dade and Broward County. With increasing inventory and new construction underway, median price increases will likely temper back in 2014 to single-digit levels. With the large numbers of new condos being offered at pre-construction (primarily in Miami-Dade), the number of available units will be increasing fairly rapidly over the next 24 months.

Short Sales in Miami-Dade

By December 2013, short sales made up 13% of the inventory for single family homes and 6% of the inventory for condos on the market. The sales that occurred in December were 18% short sales of single family homes and 13% short sales of condos. From December 2012 to December 2013, short sale single family home inventory decreased by 16.5% from 812 to 678 units and short sale condo inventory decreased 12% from 644 to 567 units. The average price of short sale single family homes in 2012 was $149,000 and increased by 27.5% in 2013 to an average price of $190,000. The average price of short sale condos in 2012 was $95,000 and increased by 22% in 2013 to an average price of $116,000.

Foreclosures in Miami-Dade

By December 2013, foreclosures made up 12% of the inventory for single family homes and 9% of the inventory for condos on the market. The sales that occurred in December were 21% foreclosed single family homes and 23% foreclosed condos. From December 2012 to December 2013, foreclosed single family home inventory increased 88% from 341 to 642 units and foreclosed condo inventory increased 110% from 391 to 819 units. The average price of foreclosed homes in 2012 was $149,000 and decreased by 3% in 2013 to an average price of $145,000. The average price of foreclosed condos in 2012 was $98,000 and increased by 22% in 2013 to an average price of $120,000.

If you are a homeowner in trouble, call us and let us discuss how we can help mitigate the situation. We cannot prevent all foreclosures, but we can help you. The most important thing you can do? Contact us when you first experience financial distress. Jena was co-chairman of a Short Sale Task Force for the Realtor Association of Miami-Dade County and has been certified in the short sale process.

Buyers

Now is the perfect time for many of you to find the right, affordable home. If you are considering purchasing a Short Sale or Foreclosure, there are some key things to keep in mind. First of all, all short sale transactions must be approved by the bank. Because the banks are inundated right now, the process from contract-to-closing has gone from 30-60 days to as long as one year. Secondly, with the changing governmental interventions some potential sellers are pulling short sales off the market and trying to keep their homes. Lastly, a short sale can turn into a foreclosure and the home can go to auction if the bank is not able to resolve the short sale to their satisfaction in the time allotted. In the last quarter of 2013, lenders began an auction process for buyers to purchase properties listed as Short Sale. The forecast for 2014 is an increase in foreclosures.

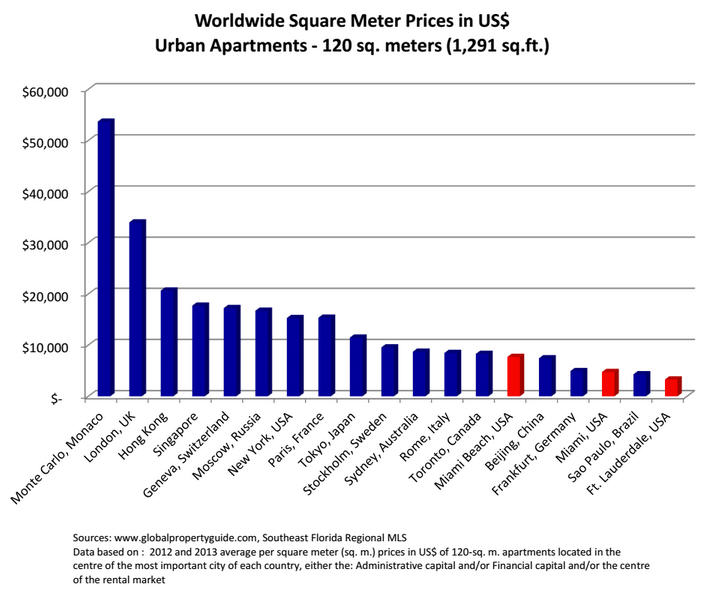

A report from Christie’s International Real Estate includes Miami, New York and London as three of the most vibrant world cities currently attracting the globally affluent buyers. The graph below offers a closer look at the overall market in Miami-Dade and a Worldwide Price Comparison sheet and Currency Exchange Rate Comparisons, highlighting the tremendous values that South Florida is offering to our friends from all across the world.

We look forward to speaking with you if you need assistance with any real estate matter. And always, we value your referrals.